8th Pay Commission Salary Calculator

This calculator will help you to calculate your salary according to 8th pay commission with the steps shown.

Neetesh Kumar | January 24, 2025

Share this Page on:

![]()

![]()

![]()

![]()

![]()

- 1. Introduction to the 8th Pay Commission Salary Calculator

- 2. What is the Formulae used

- 3. How do I find the 8th Pay Commission Salary?

- 4. Why choose our 8th Pay Commission Salary Calculator?

- 5. A Video for explaining this concept

- 6. How to use this calculator?

- 7. Solved Examples on 8th Pay Commission Salary

- 8. Frequently Asked Questions (FAQs)

- 9. What are the real-life applications?

- 10. Conclusion

With every new pay commission, employees eagerly anticipate how their salaries will change. The 8th Pay Commission Salary Calculator is a powerful tool to help you estimate your revised salary accurately and efficiently. Whether you’re a government employee or analyzing the financial impact of the 8th Pay Commission for research or planning purposes, this calculator is designed to simplify complex calculations.

1. Introduction to the 8th Pay Commission Salary Calculator

The 8th Pay Commission will bring updates to salary structures, allowances, and benefits for government employees. This calculator helps you predict your revised salary based on the expected pay matrix, fitment factor, and allowances.

Our 8th Pay Commission Salary Calculator supports both individual calculations and bulk entries in a tabular format. It’s a perfect tool for employees, HR professionals, and financial planners who need quick and accurate estimations.

History of Pay Commissions in India

The Pay Commission in India is a government body established periodically to review and revise the salary structure of central government employees, defense personnel, and pensioners. The commission evaluates economic conditions, inflation, and cost of living before recommending changes.

1st Pay Commission (1946-1947)

- Chairperson: Srinivasa Varadachariar

- Year of Implementation: 1947

- Basic Pay Structure: ₹55 - ₹200

- Key Features:

- Focused on ensuring minimum wage based on the needs of employees.

- Introduced equal pay for equal work.

2nd Pay Commission (1957-1959)

- Chairperson: Jaganath Das

- Year of Implementation: 1959

- Basic Pay Structure: ₹80 - ₹560

- Key Features:

- Recommended 15% increase in salaries.

- Considered inflation and cost of living.

- Introduced the concept of three pay scales: Lower, Middle, and Higher.

3rd Pay Commission (1970-1973)

- Chairperson: Raghubir Dayal

- Year of Implementation: 1973

- Basic Pay Structure: ₹196 - ₹2000

- Key Features:

- Emphasized social security benefits.

- Recommended House Rent Allowance (HRA), City Compensatory Allowance (CCA), and Medical Benefits.

- Introduced productivity-based incentives.

4th Pay Commission (1983-1986)

- Chairperson: P.N. Singhal

- Year of Implementation: 1986

- Basic Pay Structure: ₹750 - ₹8,000

- Key Features:

- Recommended a 27% hike in salaries.

- Suggested improvements in pension schemes.

- Introduced Leave Travel Concession (LTC) benefits.

5th Pay Commission (1994-1997)

- Chairperson: S. Ratnavel Pandian

- Year of Implementation: 1997

- Basic Pay Structure: ₹2,550 - ₹30,000

- Key Features:

- Recommended 100% increase in basic pay.

- Merged 50% of Dearness Allowance (DA) with basic pay.

- Revised pension benefits for retirees.

6th Pay Commission (2006-2008)

- Chairperson: B.N. Srikrishna

- Year of Implementation: 2008

- Basic Pay Structure: ₹7,000 - ₹80,000

- Key Features:

- Introduced the Pay Band and Grade Pay system.

- Increased minimum salary to ₹7,000.

- Merged various allowances for simplicity.

- Introduced performance-based incentives.

7th Pay Commission (2014-2016)

- Chairperson: A.K. Mathur

- Year of Implementation: 2016

- Basic Pay Structure: ₹18,000 - ₹2,50,000

- Key Features:

- Introduced a new pay matrix system.

- No Grade Pay system (replaced with levels in the pay matrix).

- Recommended a 23.55% increase in salaries.

- Increased minimum pay to ₹18,000.

- Improved pension structure for government employees.

Upcoming: 8th Pay Commission (Expected 2024-2026)

- Expected Implementation: 2026

- Expected Basic Pay: ₹26,000 (minimum salary)

- Key Expectations:

- Further revision of the pay matrix.

- Adjustments based on inflation and cost of living.

- Better allowance structure and pension benefits.

Conclusion

The Pay Commission plays a critical role in improving the financial well-being of government employees by revising their salaries and benefits based on economic conditions. Each commission has introduced significant salary hikes, pension revisions, and new pay structures.

Would you like a detailed comparison of each commission’s salary structure?

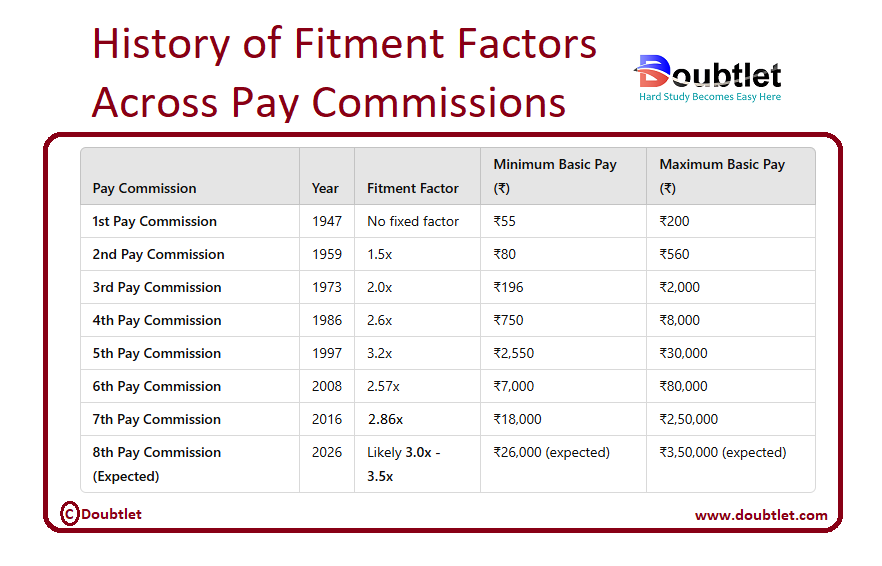

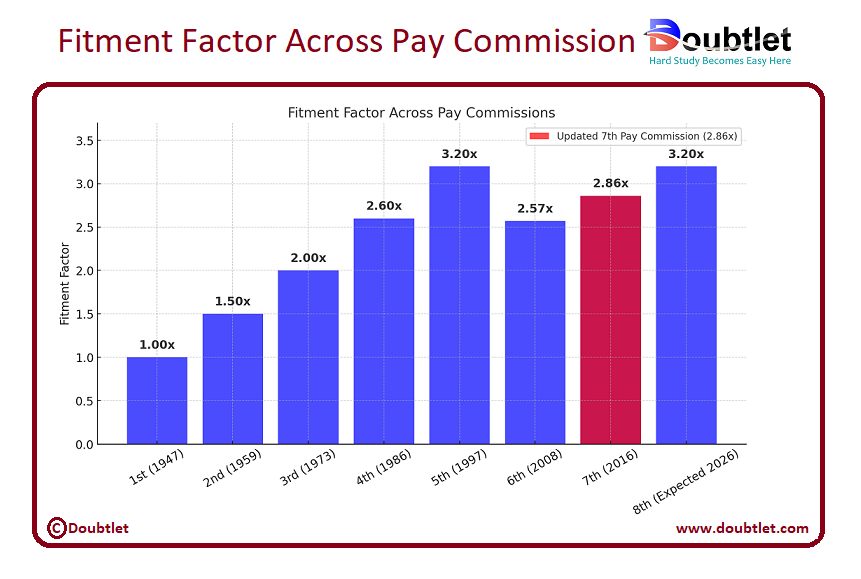

Pay Commission Fitment Factor History in India

The Fitment Factor (or Multiplication Factor) in Pay Commissions determines how much the basic pay of government employees is increased when transitioning to a new pay structure. It is a multiplier applied to the existing basic salary to calculate the revised salary under a new Pay Commission.

Explanation of Fitment Factor Across Pay Commissions

- 1st Pay Commission (1947): No fixed formula, focused on setting a minimum wage for government employees.

- 2nd Pay Commission (1959): Introduced a 1.5x increase, recognizing inflation and cost of living.

- 3rd Pay Commission (1973): Increased salaries by 2x, adding allowances and benefits.

- 4th Pay Commission (1986): Raised salaries by 2.6x, reforming pension structures.

- 5th Pay Commission (1997): Introduced a 3.2x fitment factor, providing a 100% increase in pay.

- 6th Pay Commission (2008): Standardized 2.57x across all levels, introduced the Pay Band & Grade Pay system.

- 7th Pay Commission (2016): Retained 2.86x, replaced Grade Pay with a Pay Matrix system.

- 8th Pay Commission (Expected in 2026): Anticipated 3.0x - 3.5x fitment factor, potentially increasing minimum pay to ₹26,000.

How to Calculate Salary Using Fitment Factor

If a government employee had a basic salary of ₹10,000 under the 6th Pay Commission, their new salary in the 7th Pay Commission was:

For the 8th Pay Commission (expected 3.0x - 3.5x fitment factor), the projected salary could be:

Conclusion

The Fitment Factor plays a key role in ensuring salary adjustments match inflation, cost of living, and economic growth. The 8th Pay Commission is expected to introduce a higher fitment factor (3.0x - 3.5x), resulting in significant salary increases for government employees.

Would you like an estimation of your salary under the 8th Pay Commission?

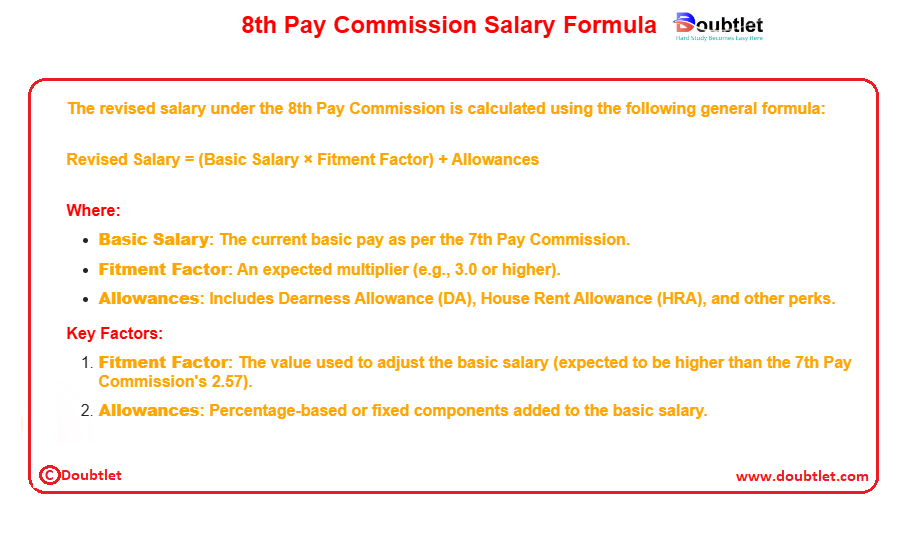

2. What is the Formulae used?

The revised salary under the 8th Pay Commission is calculated using the following general formula:

Revised Salary = (Basic Salary × Fitment Factor) + Allowances

Where:

- Basic Salary: The current basic pay as per the 7th Pay Commission.

- Fitment Factor: An expected multiplier (e.g., 3.0 or higher).

- Allowances: Includes Dearness Allowance (DA), House Rent Allowance (HRA), and other perks.

Key Factors:

- Fitment Factor: The value used to adjust the basic salary (expected to be higher than the 7th Pay Commission's 2.57).

- Allowances: Percentage-based or fixed components added to the basic salary.

3. How Do I Find the 8th Pay Commission Salary?

To calculate your revised salary manually:

- Determine Current Basic Salary: Refer to your current 7th Pay Commission pay scale.

- Apply the Fitment Factor: Multiply your basic salary by the expected fitment factor.

- Add Allowances: Include DA, HRA, and other applicable allowances.

Example Calculation:

Current Basic Salary: ₹50,000

Fitment Factor: 3.0

Allowances (DA + HRA + Others): ₹20,000

Revised Salary = (50,000 × 3.0) + 20,000 = 1,70,000

For bulk calculations or more precise estimations, our calculator automates this process for multiple employees or pay levels.

Understanding Pay Commissions in India

The Pay Commission in India is a government body set up periodically to review and recommend changes to the salary structure of central government employees. Each Pay Commission proposes revisions in:

- Pay Matrix: Determines the basic salary for various levels.

- Allowances: Such as house rent, transport, and dearness allowance (DA).

- Pension: For retired government employees.

The 8th Pay Commission (yet to be officially implemented as of now) would follow the patterns of previous commissions (e.g., the 7th Pay Commission), focusing on increasing basic salary and allowances to account for inflation and cost of living.

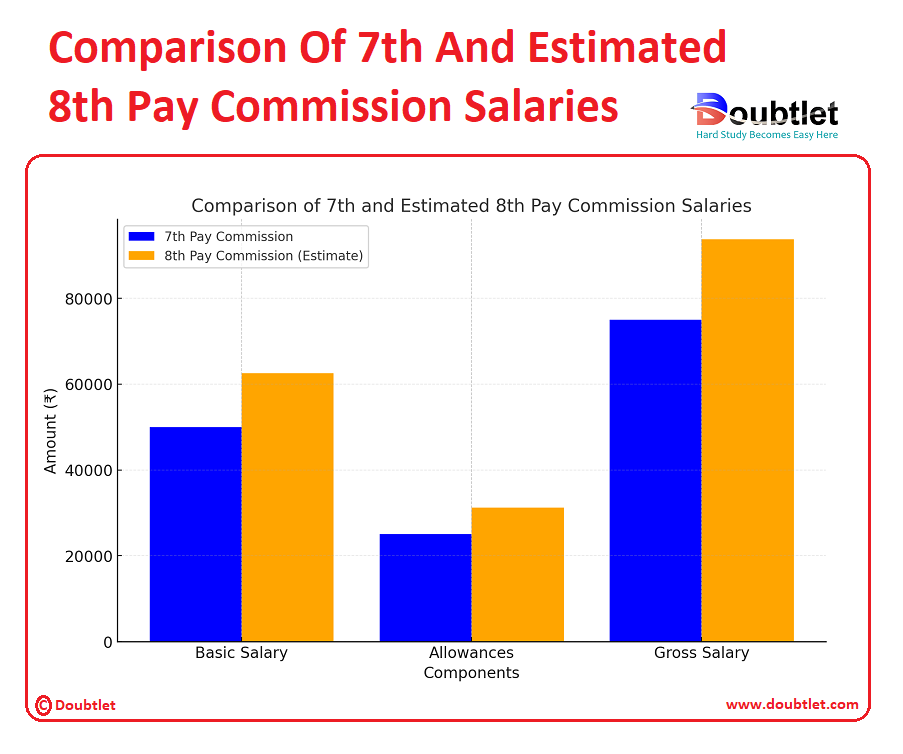

Example: Estimating 8th Pay Commission Salary

Problem: A central government employee currently earns a basic salary of ₹50,000 under the 7th Pay Commission. Based on expected changes in the 8th Pay Commission, the basic salary is estimated to increase by 25%. Calculate the revised basic salary and gross salary if allowances (50% of the basic salary) remain proportional.

Solution:

-

Revised Basic Salary: The basic salary is expected to increase by 25%:

-

Allowances: Allowances are typically 50% of the basic salary:

-

Gross Salary: The gross salary is the sum of the basic salary and allowances:

Answer:

-

Revised Basic Salary: ₹62,500,

-

Revised Allowances: ₹31,250,

-

Gross Salary: ₹93,750.

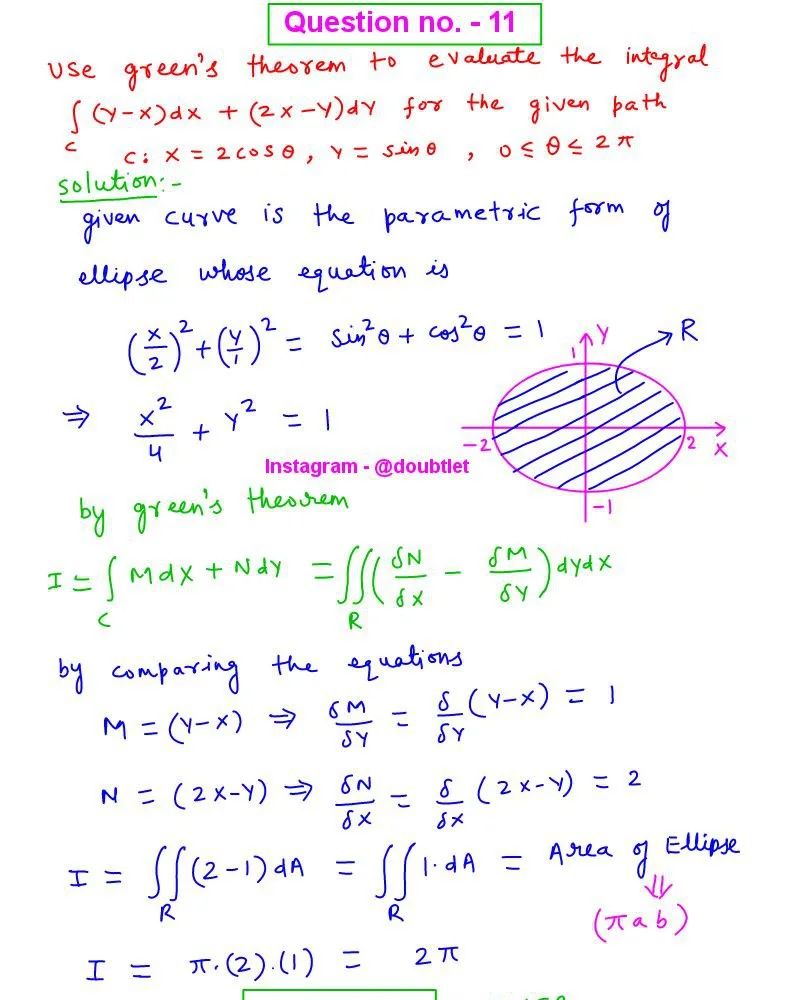

Graph Explanation

Let’s plot a graph comparing the current (7th Pay Commission) and estimated 8th Pay Commission salaries.

Explanation of the Graph:

-

Categories:

- Basic Salary: The core fixed salary component.

- Allowances: Additional benefits proportional to the basic salary.

- Gross Salary: The total salary including basic and allowances.

-

Bars:

- Blue Bars: Represent the current salary under the 7th Pay Commission.

- Orange Bars: Represent the estimated salary under the 8th Pay Commission.

-

Insights:

-

The estimated basic salary increases by 25%, reflecting the expected revision in the 8th Pay Commission.

-

Allowances also rise proportionally, leading to an overall increase in gross salary.

-

Key Takeaway:

The 8th Pay Commission's salary revision can significantly improve employees' compensation, positively impacting their purchasing power and financial well-being.

4. Why Choose Our 8th Pay Commission Salary Calculator?

Our calculator page provides a user-friendly interface that makes it accessible to both students and professionals. You can quickly input your square matrix and obtain the matrix of minors within a fraction of a second.

Our calculator saves you valuable time and effort. You no longer need to manually calculate each cofactor, making complex matrix operations more efficient.

Our calculator ensures accurate results by performing calculations based on established mathematical formulas and algorithms. It eliminates the possibility of human error associated with manual calculations.

Our calculator can handle all input values like integers, fractions, or any real number.

Alongside this calculator, our website offers additional calculators related to Pre-algebra, Algebra, Precalculus, Calculus, Coordinate geometry, Linear algebra, Chemistry, Physics, and various algebraic operations. These calculators can further enhance your understanding and proficiency.

5. A video based on how to Evaluate the 8th Pay Commission Salary.

6. How to use this calculator?

Using the 8th Pay Commission Salary Calculator is straightforward:

-

Input Data: Enter your current basic salary, fitment factor, and allowance percentages. For bulk entries, upload a table with the required data.

-

Click Calculate: Instantly view the revised salary for each entry.

-

Analyze Results: Use the outputs for salary planning, budgeting, or reporting.

This tool ensures quick and accurate results, even for large datasets.

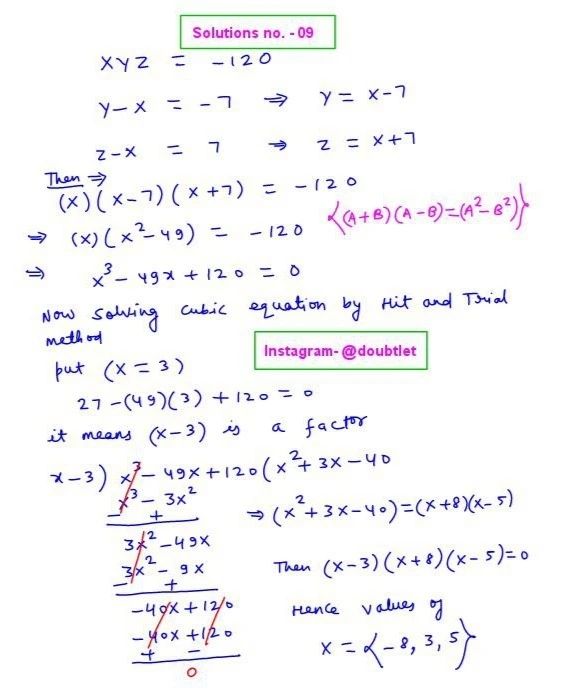

7. Solved Examples on 8th Pay Commission Salary

Example 1:

An employee earns a basic salary of ₹40,000 under the 7th Pay Commission. With an expected fitment factor of 3.2 and allowances totaling ₹15,000, what will their revised salary be?

Solution

Revised Salary

Example 2: Tabular Data:

|

|

|

|

| ||||||||

|

|

|

| ||||||||

|

|

|

| ||||||||

|

|

|

|

|

Steps:

-

Enter the data into the calculator.

-

Compute the revised salary for each row.

8. Frequently Asked Questions (FAQs)

Q1. What is the 8th Pay Commission?

The 8th Pay Commission is an expected revision of salary structures for government employees in India, following the 7th Pay Commission.

Q2. When will the 8th Pay Commission be implemented?

The implementation timeline is yet to be officially announced but is expected in the near future.

Q3. What is a fitment factor?

The fitment factor is a multiplier used to revise the basic salary. It was 2.57 in the 7th Pay Commission and is expected to be higher in the 8th Pay Commission.

Q4. Can the calculator handle bulk data?

Yes, it supports tabular data for bulk salary calculations.

Q5. Is the calculator free?

Yes, our 8th Pay Commission Salary Calculator is completely free.

Q6. Does the calculator support custom allowance percentages?

Yes, you can input custom percentages for DA, HRA, and other allowances.

Q7. Is it mobile-compatible?

Absolutely, it works seamlessly on desktops, tablets, and smartphones.

Q8. Can I export the results?

Yes, the outputs can be downloaded for further analysis or reporting.

9. What Are the Real-Life Applications?

The 8th Pay Commission Salary Calculator is invaluable for:

- Government Employees: Estimate revised salaries and plan finances.

- Human Resources: Prepare salary budgets for upcoming revisions.

- Financial Planners: Offer advice based on revised income projections.

- Researchers: Analyze the financial impact of the 8th Pay Commission.

Fictional Anecdote: Rajesh, a government employee, used our calculator to estimate his revised salary under the 8th Pay Commission. With accurate projections, he planned his investments and financial goals confidently.

10. Conclusion

The 8th Pay Commission Salary Calculator simplifies complex salary estimations, helping government employees, HR professionals, and planners prepare for the upcoming pay revision. Its accuracy, efficiency, and user-friendly interface make it a must-have tool for anyone affected by the 8th Pay Commission.

Ready to calculate your revised salary? Try our 8th Pay Commission Salary Calculator today and stay ahead of the curve!

If you have any suggestions regarding the improvement of the content of this page, please write to me at My Official Email Address: doubt@doubtlet.com

Are you Stuck on homework, assignments, projects, quizzes, labs, midterms, or exams?

To get connected to our tutors in real time. Sign up and get registered with us.

Exponential Function Calculator

Rational Zeros Theorem Calculator

BMI Calculator

Age Calculator

Simple Interest Calculator

Compound Interest Calculator

Space Travel Cost Calculator

Weight on Mars Calculator

Comments(0)

Leave a comment